TABLE OF CONTENTS

NVIDIA H100 SXM On-Demand

Machine learning in finance can improve decision-making, optimise predictions and boost security. By analysing vast datasets, machine learning models identify patterns to predict financial risks such as fraud, market fluctuations, and credit defaults. These systems provide more accurate and timely assessments than traditional methods. However, challenges like data privacy, algorithmic bias, and regulatory compliance must be addressed to maximise effectiveness.

The financial services sector contributes around 20-25% to the world economy. In 2021, the financial services sector contributed £173.6 billion to the UK economy, 8.3% of total economic output. Even the rising economies rely heavily on their financial market.

According to the latest study by International Data Corporation (IDC), global financial businesses invested nearly $16 billion in generative AI solutions in 2023. The graph is already expected to reach $143 billion by 2027 with a compound annual growth rate (CAGR) of 73.3%. But what’s the need to spend a billion dollars in machine learning when financial industries already have traditional statistical models? Traditional risk assessment methods are prone to fraudulent activities and handling vast data. This is when organisations revolutionise risk assessment using machine learning.

Machine Learning in Financial Services: Overview

The financial services industry is undergoing a major shift to improve its risk assessment with ML. The complexity of data generated in recent times is overwhelming traditional risk assessment approaches. Financial institutions are struggling to keep pace with the rapid evolution of financial markets, regulatory requirements, and customer behaviour, making it difficult to accurately identify and manage emerging risks.

This is where you use machine learning in financial risk assessment. Innovative ML algorithms can analyse vast amounts of data like credit histories, market trends, customer transactions, and social media interactions, to identify patterns that may not be apparent to traditional methods like manual processing, statistical models, and expert judgment.

Traditional vs ML-based Risk Assessment Methods

|

Feature |

Traditional Methods |

ML-Based Methods |

|

Data |

Limited to historical data |

Analyses a wide variety of data |

|

Accuracy |

Inaccurate and biased |

Accurate and unbiased |

|

Speed |

Slow and time-consuming |

Fast and efficient |

|

Adaptability |

Cannot adapt to changing conditions |

Adaptable to changing conditions |

|

Cost |

Costly |

Cost-effective |

Significance of Accurate Risk Evaluation in Finance

Accurate risk evaluation can prevent any potential threat to financial institutions, investors, clients, or any entity associated with financial services. Here’s how it can help:

-

Informed Decision-Making: Accurate risk evaluation provides financial institutions with a clear understanding of the potential risks associated with various financial decisions enabling them to make informed choices that align with their risk appetite and overall financial goals.

-

Risk Mitigation and Prevention: By identifying and evaluating risks, financial institutions can implement proactive measures to mitigate or prevent potential losses. This can involve strategies such as diversifying investments, setting credit limits, and establishing hedging strategies.

-

Financial Stability and Sustainability: Accurate risk evaluation is crucial for maintaining financial stability and ensuring long-term sustainability. By effectively managing risks, financial institutions can protect their assets, maintain investor confidence, and safeguard their reputation.

-

Regulatory Compliance and Customer Protection: Financial institutions are subject to various regulatory requirements related to risk management. Accurate risk evaluation plays a key role in ensuring compliance with these regulations and protecting customers from financial harm.

-

Competitive Advantage and Growth: Effective risk management, powered by accurate risk evaluation, can give financial institutions a competitive edge in the marketplace. By demonstrating a strong understanding and management of risks, institutions can attract investors, expand their operations, and achieve sustainable growth.

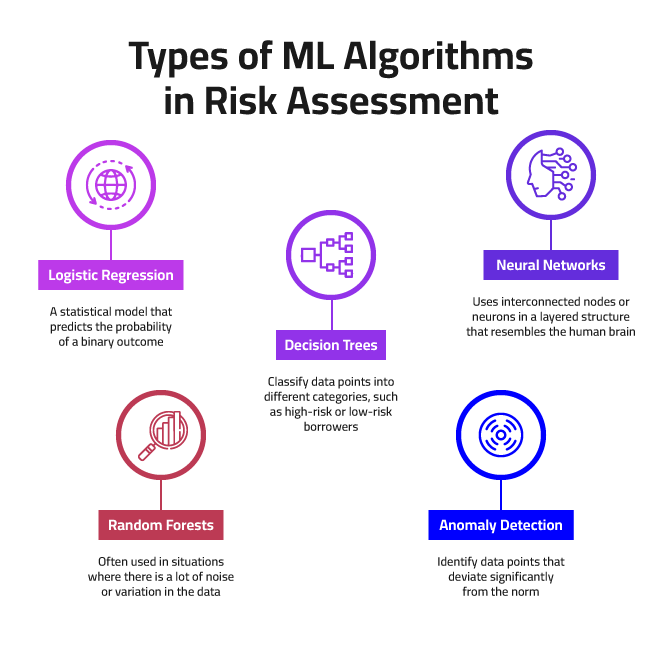

ML Algorithms Used for Risk Assessment

Several ML algorithms are commonly used in financial risk assessment. ML algorithms for risk assessment can be broadly categorized into two main types: supervised learning and unsupervised learning.

Supervised Learning Algorithms

Supervised Learning Algorithms are trained on a labelled dataset, where each data point has a corresponding output or target value. The algorithm learns to map the input data to the output values, allowing it to make predictions on new data. This increased accuracy allows company stakeholders to make strategic decisions based on the predicted numbers. For example, a supervised learning algorithm could be trained on a dataset of historical company financial data. The algorithm would learn to identify patterns in the data, such as the relationship between sales and marketing expenses. The algorithm could then use these patterns to build financial forecasting. Common supervised learning algorithms used in risk assessment market include:

- Logistic Regression

Logistic regression is a statistical model that predicts the probability of a binary outcome, such as whether a customer will default on a loan.

- Decision Trees

Decision trees are tree-like structures that make decisions based on a series of rules. They are often used to classify data points into different categories, such as high-risk or low-risk borrowers.

- Random Forests

Random forests are ensembles of decision trees, where the predictions of multiple trees are combined to improve accuracy. They are often used in situations where there is a lot of noise or variation in the data, such as to spot irregularities in the market.

- Neural Networks

Neural networks train computers to process data in a way that is inspired by the human brain. It uses interconnected nodes or neurons in a layered structure that resembles the human brain.

Unsupervised Learning Algorithms

Unsupervised learning algorithms are trained on unlabelled data, where there are no corresponding output values. The algorithm learns to identify patterns and relationships in the data without any guidance. Common unsupervised learning algorithms used in risk assessment include:

- K-means clustering

K-means clustering is an algorithm that groups data points into a predefined number of clusters based on their similarity. It is often used to identify groups of customers with similar risk profiles.

- Anomaly Detection

Anomaly detection algorithms identify data points that deviate significantly from the norm. They are often used to detect fraudulent activity or unusual market movements.

Applications of ML Algorithms in Risk Assessment

ML algorithms are used in a wide range of risk assessment applications in finance, including

- Credit Risk Assessment

ML algorithms are used to assess the creditworthiness of borrowers, helping lenders make informed decisions about loan applications.

- Market Risk Assessment

ML algorithms are used to predict market movements and assess the potential impact of market changes on financial positions.

- Fraud Detection

ML algorithms are used to detect fraudulent transactions in real-time, preventing financial losses and safeguarding customer data.

- Operational Risk Assessment

ML algorithms are used to identify and assess operational risks, such as system failures and human errors.

-

Regulatory Compliance

ML algorithms are used to monitor compliance with regulatory requirements and identify potential violations.

Real-Life Case Studies of Machine Learning in Financial Services

The growing use of Machine Learning in financial risk assessment has improved outcomes, accuracy, efficiency, and decision-making. Many leading companies have adopted data-driven approaches to prevent financial risk. Some of them include

Fraud Detection and Prevention in Online Banking

Company: Alibaba Cloud Solution

In the financial sector, loss caused by fraud reaches tens of billions of dollars annually. Alibaba Cloud Solution uses an ML-powered fraud and threat detection system which has helped to reduce fraud losses by over 50% for its clients. The system analyses customer transactions in real-time, identifying patterns and anomalies that may indicate fraudulent activity. This real-time analysis allows their clients to prevent fraudulent transactions before they occur, protecting their customers and reducing financial losses.

Credit Risk and Insurance Underwriting

Company: Upstart

Upstart's ML-powered credit risk assessment platform has helped to improve loan approval rates for underserved communities by 28%. The platform analyses a wider range of data than traditional credit scoring models, including alternative data sources such as education, employment history, and social media activity. This broader data set provides a more comprehensive picture of a borrower's creditworthiness, leading to fairer and more accurate lending decisions. In April 2019, Upstart provisioned over $5B in platform originations, of which 67% were fully automated through the ML underwriting process.

Market Risk Management with Predictive Analytics

Company: Barclays

Barclays' ML-powered predictive analytics platform has helped improve market risk forecasts' accuracy. Barclays used the circuit to develop a quantum version of a neural network. It was able to forecast stock prices more accurately. The platform analyses vast amounts of market data, including historical trends, news events, and social media sentiment, to identify patterns and predict future market movements. This improved forecasting capability allows Barclays to make better decisions by using AI and machine learning for risk management.

These real-life use cases demonstrate the transformative impact of ML algorithms in risk assessment across various sectors of the financial services industry.

Role of Data Analytics in Finance

Data analysis and big data play an important role in refining machine learning risk analysis, enabling financial institutions to make more informed decisions and manage risks effectively. By analyzing vast amounts of data, including credit histories, market trends, customer transactions, and social media interactions, risk assessment models can identify patterns and correlations that may not be apparent to traditional methods. This deeper understanding of financial risks allows for more accurate predictions, proactive mitigation strategies, and tailored risk assessments for individual customers or portfolios. Big data analytics also enables the development of more sophisticated risk models that can handle the complexity and volume of data generated in today's digital age. As a result, data analysis and big data are essential for financial institutions seeking to refine their risk assessment practices and enhance their overall risk management capabilities.

Advantages of ML in Risk Assessment

Almost every business in the financial services sector is using AI and financial forecasting over traditional risk assessment methods. Here’s what makes ML algorithms great for risk management:

-

Predictive Accuracy: ML algorithms can analyse vast amounts of data and identify complex patterns that may not be apparent to human analysts. This capability enables ML models to make more accurate predictions about future events, allowing financial institutions to proactively manage risks and make informed decisions.

-

Scalability: ML systems can handle large volumes of data efficiently, making them well-suited for the ever-increasing data volumes in the financial sector. Additionally, ML models can adapt to changing market conditions and regulatory requirements, ensuring that risk assessments remain relevant and up-to-date.

-

Personalisation: ML can tailor risk assessment models to individual customers or portfolios, providing more granular and precise risk insights. This personalised approach allows financial institutions to make more informed decisions about lending, investments, and other financial activities.

-

Automated Anomaly Detection: ML algorithms can effectively identify anomalies in data, which can be indicative of fraudulent activity, operational failures, or emerging risks. This automated anomaly detection capability enables financial institutions to take preventive measures and mitigate potential losses.

- Continuous Improvement: ML models can continuously learn from new data, improving their performance over time. This ongoing learning process ensures that risk assessments remain accurate and relevant as market conditions and risk profiles evolve.

Challenges of ML in Risk Assessment

Using data-driven approaches to financial risk comes with its own set of challenges. Some of the challenges of machine learning in risk management and assessment include

-

Data Privacy Concerns: The utilisation of large datasets raises concerns about data privacy and the need for robust data protection measures. Financial institutions must implement stringent data governance practices to ensure that customer data is collected, stored, and used in a responsible and compliant manner.

-

Regulatory Compliance: Financial institutions must adhere to a complex and evolving regulatory landscape, which can pose challenges when implementing ML-powered risk assessment models. Regulatory requirements may mandate specific controls and transparency measures to ensure that ML models are fair, unbiased, and auditable.

-

Human Oversight and Understanding: While ML algorithms can provide valuable insights, financial institutions must maintain human oversight and understanding of the risk assessment process. This oversight ensures that ML models are used responsibly, ethically, and in alignment with the institution's overall risk management strategy.

Future of Machine Learning in Financial Services

The role of AI in financial decision-making cannot be overstated as it is an ever-evolving technology. As AI continues to evolve within different industries, we can expect a huge wave of potential technologies for financial services in the coming years:

-

Artificial General Intelligence (AGI): AGI has the potential to revolutionize the financial services industry by automating even more complex tasks and making more sophisticated decisions than current ML models. AGI allows financial industries to develop new products and operate more efficiently and profitably.

-

Quantum Computing: Quantum computing has the potential to significantly improve the performance of ML algorithms, enabling them to analyse vast amounts of data at once and make even more accurate predictions. This could have a major impact on risk assessment, fraud detection, and other financial applications.

-

Explainable AI (XAI): XAI is a field of research that focuses on developing techniques for making ML models more capable and transparent. This is important for building trust in ML-powered decisions, particularly in the financial services industry.

-

Natural Language Processing (NLP): NLP is a field of Artificial Intelligence that deals with the interaction between computers and human language. NLP is being used to develop chatbots and virtual assistants that can provide customer service, answer questions, and even make financial recommendations.

-

Edge Computing: Edge computing is a distributed computing paradigm that brings computation and data storage closer to the location where it is needed. Edge computing is being used to develop fraud detection systems and provide personalized financial services to customers.

Conclusion

The use of machine learning in financial risk assessment has proven to be a game changer. Machine learning has made complexities in the financial services industry a lot easier for both companies and clients. Its data-driven approaches to financial risk now help millions of businesses across the globe to make informed decisions, prevent potential fraud, and boost customer satisfaction and market growth.

Hence, choosing the right AI/ML partner is important for financial institutions to reach the full potential of machine learning. Hyperstack, a trusted GPU cloud partner for leading financial institutions in Europe provides cutting-edge technology and expertise needed for groundbreaking financial risk assessment solutions. With our state-of-the-art NVIDIA GPUs like the NVIDIA A100 and H100 and seamless integration with the Infrahub API, you can train your ML models with unmatched speed and efficiency.

FAQs

What is the role of AI and ML in financial services?

AI and ML in financial services help in informed decision-making, risk management, and customer experience. They automate complex tasks like fraud detection, personalise banking services, and optimise investment strategies. AI-powered chatbots improve customer interactions, while ML algorithms predict market trends and credit risks, making financial operations more efficient and accurate.

How is machine learning used in finance?

Machine learning in finance is primarily used for predicting market trends, managing risks, and detecting fraud. By analysing vast datasets, ML algorithms forecast stock movements, identify potential risks in investment and spot unusual transaction patterns to prevent fraud.

What is the best machine learning algorithm for finance?

For predictive analysis, algorithms like Random Forest are popular for their accuracy and ability to handle large datasets. Neural Networks, especially deep learning in financial services, are effective for complex tasks like market prediction and algorithmic trading. For risk management and fraud detection, clustering algorithms like K-Means are widely used. The choice depends on the data characteristics and the financial task at hand.

Sign up for a free Hyperstack account today and experience the power of AI/ML with the right partner by your side!

Subscribe to Hyperstack!

Enter your email to get updates to your inbox every week

Get Started

Ready to build the next big thing in AI?